MALIBU BOATS

Recent Price: 41

Expected annualized return: 28%

Expected Horizon: 10 years

Nov 15, 2024

Business Overview:

Malibu Boats is a leading manufacturer of recreational watercraft, specializing in high-performance, innovative boats designed for water sports enthusiasts. The company offers a diverse lineup of premium wakeboard, wakesurf, and ski boats, known for cutting-edge technology, sleek design, and superior craftsmanship. With a commitment to providing the ultimate on-water experience, Malibu Boats caters to a global customer base through its core brands: Malibu, Axis Wake Research, and Cobalt Boats.

Business Strategy

Malibu Boats' strategy focuses on maintaining industry leadership by prioritizing innovation, product quality, and customer satisfaction. The company invests heavily in research and development to introduce proprietary technologies that enhance performance and user experience. Vertical integration allows Malibu to control key components of manufacturing, ensuring high quality and operational efficiency. To drive growth, Malibu pursues strategic acquisitions, expands its product portfolio, and strengthens its dealer network while capitalizing on strong brand loyalty and increasing global demand for recreational watercraft.

Why is the stock down?

Malibu Boats, along with its peers, benefited from industry tailwinds, experiencing revenue and profit growth driven by low interest rates and increased consumer interest in outdoor recreation during the COVID-19 lockdown. Year-on-year (YoY) revenue growth peaked at 28% in December 2022 but declined to -57% YoY by June 2024, marking the end of its 2024 fiscal year. The stock has also suffered more than its peers due to a legal claim from one of its main dealerships, alleging that Malibu Boats pressured them to significantly increase their credit facility to accommodate large amounts of unsellable, high-margin inventory. As a result, the stock has declined by 50% from its 2021 peak.

Our Take

According to Global Market Insights, the recreational boating industry is expected to grow at a compound annual growth rate (CAGR) of approximately 10% from 2024 to 2032. This growth is driven by rising disposable incomes, increased participation in water sports, and advancements in boat technology that enhance safety and performance. The industry, while cyclical, includes well-established players and dynamics that align with our investment strategy. Malibu Boats has maintained a stable 30% market share in two of its three business segments (Performance Boats and Sterndrive), contributing to a 10-year average return on invested capital (ROIC) of 22%, exceeding its cost of capital. Malibu Boats ROIC also tells the story of successful acquisitions from the company´s management.

Malibu’s cost structure is notable, with nearly 80% of its costs being variable despite its vertical integration, allowing the company to manage economic challenges more effectively. The company also maintains a strong balance sheet, with a debt-to-capital ratio of just 6%, positioning it strongly to weather a downcycle.

Recent results suggest some stabilization. In the first quarter of 2025, YoY revenue declined by 37%, an improvement from the -57% decline in the previous quarter. Inventory is also starting to destock, declining from a peak of $185.6 million in December 2022 to $146.9 million in September 2024. This 20.9% reduction over seven quarters indicates a positive trend towards stabilization, particularly beneficial for a consumer discretionary business like Malibu Boats." Regarding the legal claim, Malibu has settled to pay $3.5 million, an amount on the lower end of market expectations.

How do we think we are going to get our returns?

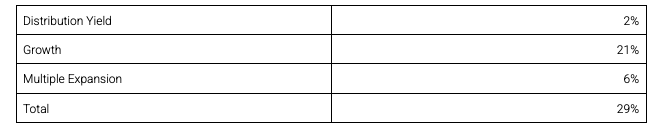

Distribution Yield: While Malibu Boats does not pay a dividend, it has consistently repurchased stock over the last five years, excluding 2020. These buybacks have averaged $20 million annually, representing a yield of approximately 2% based on Malibu’s current enterprise value.

Growth: If the company continues to reinvest 88% of its earnings at an ROIC of 20%, growth from reinvested capital could generate returns of about 18%. Adding a conservative organic growth rate of 3% suggests a potential total annual return of 21%.

Multiple Expansion: Malibu currently trades at a price-to-book ratio of 1.5, compared to its five-year average of 2.9 and a sector median of 2.5. If the multiple reverts to its historical mean, holding the stock for ten years could result in an annualized return of approximately 6% from multiple expansion.

Overall, we estimate a potential annualized return of 29% over a 10 year period, as expressed in the following table:

Position Strategy

Why would we sell?

-If the company faces additional legal issues similar to the Tommy Boats claim. Notably, CEO Jack Springer left the company shortly before this claim became public.

-If the company pursues acquisitions that deviate significantly from its core competencies.

Why would we hold?

-If the company maintains its high ROIC despite shifts in market sentiment.

-If the prolonged downcycle driven by high interest rates continues, provided the company’s fundamentals remain strong.

Why would we add more?

-If margins and growth show consistent improvement, but the market fails to reflect this in its valuation.

This report is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities. The information contained herein is based on sources believed to be reliable, but its accuracy and completeness cannot be guaranteed.

Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal. For more information regarding Taler Capital Management investment approach and investment products visit www.talercapital.com